Our Proven Holistic Wealth

Management Process

Purposeful Planning, Built Around You

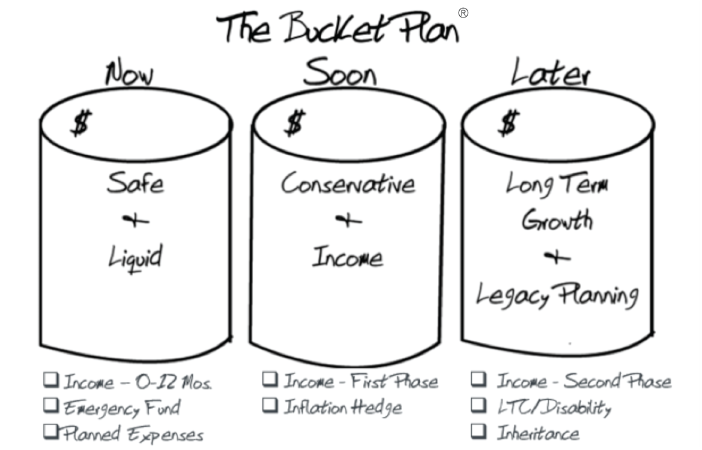

A Smarter Way to Structure Your Retirement

- Now Bucket: Emergency cash and short-term income you’ll need in the next 1-3 years

- Soon Bucket: Accessible savings you may need over the next 10 years

- Later Bucket: Long-term growth, legacy, and inflation protection

This approach helps secure a steady income in retirement by replacing your paychecks with designated “safe money,” not money that’s exposed to market fluctuations. By ensuring you always have access to the right money at the right time, The Bucket Plan® works proactively to mitigate key risk factors—cash flow instability, unmanaged taxes, and economic turbulence—that could compromise a successful retirement.

The Grow, Keep, Leave Philosophy

We believe the best way to make money is to avoid losing it in the first place. Our protection-focused planning philosophy is centered around three core ways of helping you build, protect, and pass on your wealth with purpose and precision.

GROW

KEEP

LEAVE

Working With Us – What You Can Expect

Your Blueprint for Long-term Success

From our first consultation to the long-term implementation of your plan, here is what you can expect from working with us:

Discover The Bucket Plan® Book

The Bucket Plan®: Protecting and Growing Your Assets for a Worry-Free Retirement offers a straightforward explanation of the planning approach we use every day with clients. It’s a helpful resource to deepen your understanding and see how the strategy applies to your own financial life. The Bucket Plan book was recognized by U.S. News & World Report as one of the top financial planning books of 2023 and listed among Entrepreneur.com’s top 15 books for retirement in 2024.

Our Commitment to You

As our valued client, you deserve nothing less than a clear, intentional strategy to guide your financial future, and the peace of mind that comes with knowing every piece fits. At Assured Concepts, no client gets a “set it and forget it” experience. Our team of experienced advisors combines diverse perspectives and credentials to anticipate challenges, solve complex problems, and keep your plan aligned as life changes. Connect with us now and let’s build a better financial future—together.

Join Our Insider’s List

Sign up to get news, insights, and invites to virtual and in-person events in East Dundee and Barrington, IL delivered straight to your inbox.

By signing up you'll also receive access to future resources right in your inbox.