Holistic Wealth Management Services in Greater Chicago

Protecting and growing your wealth, assuring you

We believe the best way to build financial confidence is by reducing what you could lose. Our approach begins with a clear-eyed view of retirement risks—then a plan that helps protect you from them. Whether that means replacing a paycheck, minimizing your lifetime tax burden, or ensuring your loved ones are cared for, our services are designed to secure what you’ve built and support the life you want to lead.

We believe the best way to build financial confidence is by reducing what you could lose. Our approach begins with a clear-eyed view of retirement risks—then a plan that helps protect you from them. Whether that means replacing a paycheck, minimizing your lifetime tax burden, or ensuring your loved ones are cared for, our services are designed to secure what you’ve built and support the life you want to lead.

Creating a stable and safe income once the paychecks go away. Tax-optimized to minimize losses and stay predictable long-term.

Minimizing excessive taxes that can erode your wealth in retirement. Some of our clients are surprised to learn that solving this issue does not require a reduction in your planned lifestyle, and in fact can often have the inverse result!

Mitigating the financial impact of unforeseen events. We build your plan to help protect against financial vulnerabilities due to unforeseen circumstances; for example, if one spouse passes prematurely and the surviving spouse is left with one Social Security check, possibly a reduced or eliminated pension, and an increased single filer tax base.

Making sure your family stays protected. We take all the steps to properly protect your wealth for your heirs—not the IRS, potential ex-spouses, or other creditors.

What We Offer

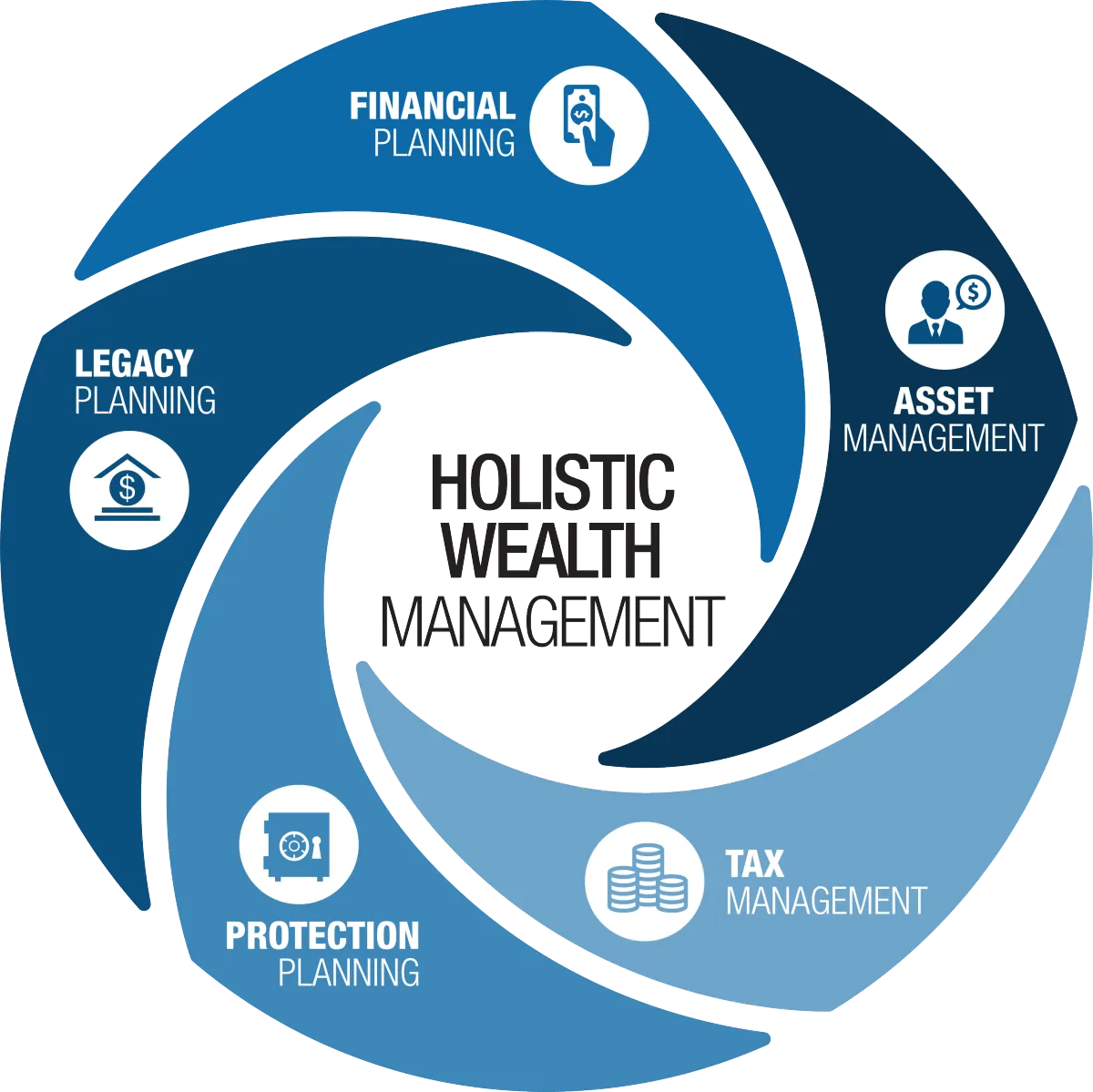

Our planning process is built on the Five Pillars of Holistic Wealth Management: financial planning, tax management, asset management, legacy planning, and protection planning. Aligning every part of your financial life, this holistic method allows each financial decision to support the next, ensuring all aspects of your plan work in harmony.

These five pillars are complimented by two key services that enhance and differentiate our approach: in-house tax preparation and Medicare planning. Together, all these elements form a strategy that does more than help you grow wealth—it helps you retain it, protect it, and use it with intention.

Financial Planning

The blueprint for a secure future

A strong plan should do more than show you what’s possible—it should protect you from what’s preventable. That’s why we use The Bucket Plan®. Offered in two core tiers depending on your needs, our financial planning services help you organize assets for near-, mid-, and long-term use. The Bucket Plan® also incorporates tax-smart withdrawal and spending strategies, and addresses potential income shortfalls before they become real problems.

We only charge a planning fee if you choose to move forward with the blueprint we design. If you don’t see the value, there’s no charge and no work done on your future planning. It’s our way of making sure your trust is earned, not assumed.

Tax Management

Protecting against preventable losses

One thing we often ask when talking taxes with our clients is, “What are you possibly losing by not protecting yourself, and are you willing to take that risk?” Taxes are often the single largest expense in retirement—and the most overlooked. While tax planning is valuable, it’s only part of the equation: tax management is what keeps the tax plan vital, flexible, and aligned with your changing life.

At Assured Concepts Group, we build ongoing tax management into your overall wealth plan to help reduce liabilities and retain more of your wealth. We do this by:

Helping reduce exposure to taxation through ongoing tax plan adjustments

Optimizing income streams and avoid Medicare surcharges

Preserving assets across generations with lifetime tax modeling

Because the only thing better than growing your wealth is not losing it in the first place.

Asset Management

Making sure your money works for you

We believe your investments should be structured to support your plan, not just chase performance. As fiduciary advisors, we design portfolios around your timeline, your tax strategy, and your future goals, always with your best interests as the priority. Our founder has deep expertise of the ins and outs of investing strategically, holding his Securities Industry Essentials (SIE) license for over 25 years. Assured Concepts was built around sound investment guidance, and with us you can expect:

Dynamic, goal-oriented portfolio management

Strategies built for income and longevity, not speculation

Tax-aware investing to help minimize surprises and maximize your ideal outcomes

Legacy Planning

Your wealth, your way

A solid legacy plan protects the people you love from problems you can prevent. With decades of legacy planning experience and a certified estate planning advisor at the helm, we take your future and your loved ones’ comfort very seriously. After getting to know your needs and wishes, we work to make sure your legal documents are in order, financial plan written to account for every possible angle and circumstance to help shield against losses and ensure seamless wealth transfer. Our legacy planning services include:

Creating tax-efficient, purpose-driven legacy plans with risk-aware language

Thoroughly planning for your surviving spouse

Involving adult children early for smoother transitions and family continuity

Protection Planning

Preparation, not prediction

From market corrections to major health events, real financial risks often show up without warning. Our protection planning strategies help create durable safeguards so your retirement can weather life’s unknowns. We help you with:

Income protection and long-term care planning

Contingency planning for life transitions or health issues

Building a stable foundation for growth

Tax Services

Tax strategy that looks beyond the return

We believe tax planning is essential to smart retirement strategy. That’s why we’re proud to offer advanced tax services specifically for our advisory clients. Our tax team includes credentialed Enrolled Agents and Ed Slott Master Elite Advisors who offer:

Free tax preparation for advisory clients

Integration with your tax strategy—your tax return becomes a living document we use to project liabilities, identify risks, and shape your future decisions

Ongoing guidance on Roth conversions, gifting, capital gains management, and income structuring and Coordination with investment and distribution strategies

Medicare Planning

A smarter approach to one of retirement’s biggest expenses

Healthcare costs in retirement can derail a good plan. Our in-house Medicare specialist works with your advisor to help you make informed, timely, and cost-effective Medicare choices that support your retirement income strategy. This includes:

Income-aware planning to mitigate IRMAA (Income-Related Monthly Adjustment Amount) penalties

Guidance on timing Social Security withdrawals to avoid premium increases

Education and support during enrollment windows to help you choose the right plans with confidence

We Don’t Plan for the Future—We Solve for What’s Coming

At Assured Concepts Group, our role is not to predict the future but to make sure you’re prepared and protected, any way it turns out. That means building financial strategies rooted in risk mitigation, tax efficiency, and long-term wealth protection that account for what you know, what you don’t, and what you could lose by overlooking the details.

Let’s create a retirement plan that can help you keep more, worry less, and live well—book your call with an advisor today.

Working With Us – What You Can Expect

Your Blueprint for Long-term Success

From our first consultation to the long-term implementation of your plan, here is what you can expect from working with us:

Discover

We’ll get to know you, your goals, and your current financial picture, answer any questions you may have, and determine whether we are a good fit for each other.

Design

We create and present a personalized planning blueprint proposal. Based on your financial situation and future goals, you will have a choice between:

- A foundational plan for retirement readiness and income distribution, or

- A full tax plan with detailed distribution strategy and legacy structure.

Deliver

If you would like to move forward with the plan we’ve created, we will establish our working relationship and put your blueprint into action. However, if you do not see value in the blueprint we created and choose not to move forward with the plan, we will waive the fee—no obligation, no pressure.

Dedicated

We become your advisory team for guiding tax, investment, and estate planning decisions year after year, with in-person meetings and adjusting your plan regularly as your life changes.

Join Our Insider’s List

Sign up to get news, insights, and invites to virtual and in-person events in East Dundee and Barrington, IL delivered straight to your inbox.

By signing up you'll also receive access to future resources right in your inbox.

Check the background of your financial professional on FINRA’s website: BrokerCheck

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by outside parties to provide information on a topic that may be of interest. These outside parties are not affiliated with the named representative, broker – dealer, state – or SEC – registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Assured Concepts Group Ltd. is neither a broker-dealer nor an investment adviser. Securities and Variable Insurance products are offered through Purshe Kaplan Sterling Investments www.pksinvest.com, member FINRA / SIPC , www.finra.org, www.sipc.com. Advisory services provided through Assured Advisory Group, LLC, a Registered Investment Advisory Firm. Purshe Kaplan Sterling Investments is a full service brokerage firm, operated primarily through independent registered representatives. Investing involves risk including loss of principal. The information provided is not directed at any investor or category of investors and is provided solely as general information about products and services or to otherwise provide general investment education.

Copyright © 2026 Assured Concepts Group, Ltd. All Rights Reserved.